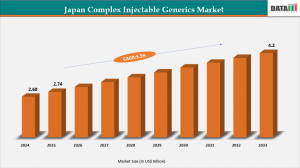

Japan Complex Injectable Generics Market is expected to reach US$ 4.2 Billion by 2033 | DataM Intelligence

The Japan Complex Injectable Generics Market is expected to reach at a CAGR of 5.5% from 2026 to 2033.

The Japan Complex Injectable Generics Market is poised for steady growth, driven by rising demand for biosimilars, advanced formulations, and cost-effective therapies.”

OSAKA, TOKYO, JAPAN, February 18, 2026 /EINPresswire.com/ -- Market Overview:— DataM Intelligence

The Japan Complex Injectable Generics Market has emerged as a critical segment within the broader pharmaceutical industry, driven by rising demand for advanced injectable therapies and increasing healthcare expenditure. Complex injectable generics are medicines that require specialized manufacturing processes, including biologics, high-potency drugs, and formulations that involve sophisticated delivery systems. Japan, with its advanced healthcare infrastructure, a growing aging population, and increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, has created a significant demand for cost-effective and high-quality complex injectable generics.

To Download Sample Report Here: https://www.datamintelligence.com/download-sample/japan-complex-injectable-generics-market

According to DataM Intelligence, The Japan Complex Injectable Generics Market was valued at approximately USD 2.60 billion in 2024 and is projected to reach USD 4.2 billion by 2033, growing at a CAGR of 5.5% during the forecast period. The market’s growth is largely driven by the government’s push for affordable healthcare, increasing patent expirations of branded injectables, and a surge in hospital-based and outpatient therapies. Among product segments, high-potency injectables dominate due to their critical role in oncology treatments, while metropolitan regions such as Tokyo and Osaka lead in market adoption, owing to the concentration of advanced hospitals, specialized healthcare providers, and strong logistics networks.

Key Highlights from the Report:

Japan Complex Injectable Generics Market is expected to grow at a CAGR of 5.5% between 2026 and 2033.

High-potency injectables remain the leading product segment, accounting for over 45% of market share.

Oncology and autoimmune disease treatments drive maximum adoption of complex injectables.

Hospital pharmacies and specialty clinics are the primary end-users of these formulations.

Tokyo and Osaka are the key regional markets due to advanced healthcare infrastructure.

Patent expirations of major branded injectables are opening growth opportunities for generics manufacturers.

Market Segmentation:

The Japan Complex Injectable Generics Market can be segmented based on product type, end-user, and formulation. By product type, the market includes high-potency injectables, lyophilized formulations, and biologics. Among these, high-potency injectables dominate due to increasing use in oncology treatments, where precision dosing and safety are critical. Lyophilized injectables are also gaining traction, particularly in hospitals, due to their longer shelf life and ease of storage. Biologics represent a rapidly emerging segment, especially with the patent expiry of several blockbuster biologics and the rising adoption of biosimilars in Japan.

By end-user, hospitals, specialty clinics, and retail pharmacies are key segments. Hospitals hold the largest share due to their extensive use of injectable therapies in acute care, oncology, and chronic disease management. Specialty clinics, particularly those focusing on dermatology and oncology, are adopting complex generics to reduce treatment costs and maintain patient adherence. Retail pharmacies, while smaller in volume, are increasingly stocking prefilled syringes and other patient-friendly injectable formats, reflecting the trend toward outpatient self-administration.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/japan-complex-injectable-generics-market

Regional Insights:

Regional adoption of complex injectable generics in Japan is heavily skewed toward metropolitan areas with advanced healthcare facilities. Tokyo and Osaka emerge as dominant markets due to their concentration of tertiary hospitals, specialized oncology centers, and robust pharmaceutical supply chains. Other regions, such as Kanagawa and Aichi, are also witnessing steady growth as local hospitals and clinics increasingly adopt complex generics to manage costs and enhance treatment options.

Furthermore, government initiatives promoting generic adoption and reimbursement policies have facilitated regional expansion beyond major cities. Rural regions, although slower in adoption due to limited hospital infrastructure, are expected to experience gradual growth as telemedicine and advanced logistics improve access to injectable therapies.

Market Dynamics:

Market Drivers:

The Japan Complex Injectable Generics Market is primarily driven by an aging population, increasing incidence of chronic and oncological diseases, and rising healthcare costs. Government policies encouraging the use of generics to reduce national healthcare spending have further accelerated market growth. Additionally, advancements in injectable delivery technologies, such as prefilled syringes, autoinjectors, and lyophilized formulations, have enhanced patient convenience and safety, boosting demand in both hospital and outpatient settings.

Market Restraints:

Despite strong growth, the market faces certain challenges. Complex manufacturing processes, stringent regulatory requirements, and high initial development costs make it difficult for new entrants to penetrate the market. Moreover, the presence of established branded injectables and physician hesitation to switch patients to generics can restrict rapid adoption. Supply chain complexities and cold chain logistics requirements for biologics and high-potency drugs also pose operational challenges.

Market Opportunities:

The expiration of patents on key branded injectables presents significant opportunities for manufacturers. Additionally, the growing trend toward biosimilars and self-administered injectable therapies provides avenues for market expansion. Companies focusing on innovative formulations, cost-effective manufacturing, and patient-centric delivery systems can leverage these opportunities to gain a competitive edge. Strategic collaborations with hospitals and government initiatives to promote generics adoption are further poised to drive growth.

Looking For Full Report? Get it Here: https://www.datamintelligence.com/buy-now-page?report=japan-complex-injectable-generics-market

Frequently Asked Questions (FAQs):

How Big is the Japan Complex Injectable Generics Market?

What are the Key Growth Drivers for the Market?

Who are the Leading Players in the Japan Complex Injectable Generics Market?

What is the Projected Market Growth Rate from 2026 to 2033?

Which Region in Japan is Estimated to Dominate the Market Through the Forecast Period?

Company Insights:

Key players operating in the Japan Complex Injectable Generics Market include:

Takeda Pharmaceutical Company Limited

Daiichi Sankyo Company, Limited

Astellas Pharma Inc.

Eisai Co., Ltd.

Otsuka Pharmaceutical Co., Ltd.

Mitsubishi Tanabe Pharma Corporation

Nichi-Iko Pharmaceutical Co., Ltd.

Sawai Pharmaceutical Co., Ltd.

Towa Pharmaceutical Co., Ltd.

Meiji Seika Pharma Co., Ltd.

Fuji Pharma Co., Ltd.

Kyowa Kirin Co., Ltd.

Recent Developments:

Japan:

February 2026: Takeda Pharmaceutical strengthened its pipeline in oncology and critical care injectables. Otsuka-Towa partnership advanced, reflecting trends in collaborative production.

January 2026: Otsuka Pharmaceutical and Towa Pharmaceutical formed a strategic alliance to enhance manufacturing and secure stable supply of complex injectables. PMDA also implemented ICH-harmonized quality standards effective April 2026, speeding approvals. Astellas Pharma expanded its hospital-focused portfolio for specialty treatments.

December 2025: Liposomes emerged as the leading product segment, holding the largest revenue share due to advantages in oncology therapies. Hospitals increasingly adopted these for high-risk patients amid cost pressures.

November 2025: Nichi-Iko Pharmaceutical invested in advanced aseptic manufacturing to boost domestic production of complex injectable generics. This move addressed rising demand for high-quality sterile injectables in oncology and chronic care.

United States:

February 2026: New ANDA approvals for nanoparticle-based injectables advanced pain management options, with uptake in ambulatory centers. Policy shifts under the Trump administration emphasized generics in Medicare Part B to control costs. This spurred innovation in long-acting formulations.

January 2026: Supply chain enhancements via domestic manufacturing investments mitigated raw material shortages for sterile injectables, stabilizing prices after 2025 disruptions. Leading players expanded prefilled syringe offerings for emergency care. PBM contracts favored complex generics, driving a 12% volume uptick.

December 2025: A major U.S. generics firm launched the first interchangeable biosimilar injectable for autoimmune diseases, capturing 15% market share within weeks due to aggressive pricing. This development addressed supply shortages in rheumatology treatments. Regulatory incentives under the Biosimilar User Fee Act further boosted pipeline activity.

November 2025: The FDA accelerated approvals for complex injectable generics targeting oncology applications, easing entry for biosimilar versions of high-cost biologics amid rising demand for affordable cancer therapies. This supported market expansion by reducing approval timelines from 30 to 20 months on average. Hospital procurement groups increasingly prioritized these generics to cut specialty drug spending.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Conclusion:

The Japan Complex Injectable Generics Market is set for steady growth over the coming years, driven by a combination of demographic trends, chronic disease prevalence, and supportive government policies. High-potency injectables, biologics, and innovative delivery formats are leading the way, while metropolitan regions continue to dominate due to advanced healthcare infrastructure. Despite challenges related to manufacturing complexity and regulatory compliance, patent expirations and the adoption of biosimilars present significant opportunities. Overall, manufacturers focusing on innovation, cost efficiency, and patient convenience are well-positioned to capture a growing share of this lucrative market.

Related Reports:

Injectables Contraceptives Market

Facial Injectables Market

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

Sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.