India Used Car Market to Reach US$ 90.2 Bn by 2032, Growing at 15.5% CAGR | Persistence Market Research

India's used car market to surge to US$90.2B by 2032, driven by digital platforms, EV adoption, and rising demand for affordable mobility.

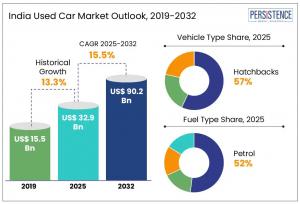

BRENTFORD, LONDON, UNITED KINGDOM, February 4, 2026 /EINPresswire.com/ -- The India Used Car Market is poised for significant growth over the coming decade, with its market size projected to escalate from US$ 32.9 billion in 2025 to approximately US$ 90.2 billion by 2032, representing a Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period from 2025 to 2032. This strong growth projection underscores the rapidly evolving dynamics of the automotive resale industry in India, shaped by changing consumer behaviors, digital transformation, and evolving regulatory landscapes.

Growth in this segment is further fueled by the proliferation of online marketplaces and professional pre-owned car dealerships that offer certified vehicles, warranties, and after-sales services—features that were once limited to new car purchases. With rising concerns over vehicle depreciation, budget constraints, and a preference for sustainable options, both individual and fleet buyers are increasingly turning to the used car space.

Get Your FREE Sample Report Instantly Click Now: https://www.persistencemarketresearch.com/samples/35243

Market Segmentation

By Vehicle Type

• Hatchbacks

• Sedans

• Sports Utility Vehicles (SUVs)

By Variant

• Base Model

• Mid Model

• Top Model

By Sales Channel

• Organized Dealers

• Unorganized Dealers

By Fuel Type

• Petrol

• Diesel

• CNG

• EVs/Hybrids

By Sales Area

• Metro Cities

• Non-metro Cities/Towns

By Brand

• Maruti Suzuki

• Hyundai

• Honda

• Tata Motors

• Mahindra

• Others

By Zone

• North India

• West India

• South India

• East India

Customize This Report for Your Exact Requirements: https://www.persistencemarketresearch.com/request-customization/35243

Regional Insights

Urban centers like Mumbai, Delhi-NCR, Bengaluru, Chennai, and Hyderabad remain the largest markets due to population density, higher purchasing power, and greater access to dealerships. Meanwhile, Tier-II and Tier-III cities are the fastest-growing regions, driven by rising incomes, improved financing options, and wider internet accessibility, enabling buyers to leverage online platforms for pre-owned vehicle purchases. This growth is expanding the market beyond traditional urban hubs.

Unique Features and Innovations in the Market

The India used car market is being reshaped by a suite of innovative solutions that enhance consumer confidence and streamline transaction processes. Modern market offerings extend beyond simple vehicle listings to encompass comprehensive service ecosystems that prioritize convenience, transparency, and post-sale support.

Technology-Driven Enhancements

One of the most defining innovations is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into platform operations. AI-powered tools are leveraged to refine price estimations, enhance search recommendations, detect anomalies in vehicle histories, and automate customer support functions. Such capabilities not only augment operational efficiencies but also elevate user experience by delivering personalized insights and reducing friction in the purchase journey.

In parallel, Internet of Things (IoT) technologies are enabling remote diagnostics and real-time condition monitoring, which help buyers assess vehicles’ mechanical health with greater precision prior to purchase. Integrated telematics solutions can provide historical data on usage patterns, engine performance, and maintenance schedules—data that were previously inaccessible or fragmented.

The rollout of 5G connectivity is further accelerating digital engagement by enabling high-speed video tours, augmented reality (AR) vehicle demonstrations, and seamless interactive experiences between buyers and sellers. This enhanced connectivity supports richer data exchanges, improves platform responsiveness, and fosters greater trust in online transactions—pivotal to sustaining long-term market growth.

Market Highlights

Several key dynamics underpin the robust adoption of used vehicles within India’s automotive landscape. Foremost among these is the cost advantage associated with pre-owned cars. In a price-sensitive market, consumers are increasingly drawn to high-quality used vehicles as a strategic alternative to purchasing new cars, enabling them to access better-equipped models or larger vehicles within budget constraints.

Additionally, favorable financing options such as tailored loan products, flexible down payments, and competitive interest rates have significantly lowered barriers to purchase. Financial institutions and fintech players have extended their footprint in the used car domain, offering risk-assessed lending solutions that cater specifically to pre-owned vehicle buyers.

The influence of government regulations and policy frameworks aimed at promoting sustainable mobility and reducing vehicular emissions also plays a formative role. Incentives for EV adoption, stricter emission norms, and the phased implementation of environmental standards have encouraged buyers to consider more efficient vehicle options—including certified pre-owned hybrid and electric cars—thereby expanding market diversity.

Key Players and Competitive Landscape

The market features a mix of established automotive groups and digital-first startups:

✦ Maruti Suzuki True Value – A pioneer in organized used car retail, leveraging Maruti Suzuki’s expansive service network to provide certified pre-owned vehicles complete with warranty and service benefits, thereby enhancing customer confidence.

✦ Mahindra First Choice Wheels – Focused on expanding nationwide dealership presence and offering comprehensive inspection, refurbishment, and certification standards, reinforcing its position as a one-stop destination for pre-owned vehicles.

✦ CarDekho – A digital-first automotive marketplace that combines advanced search tools, AI-driven recommendations, and financing options to enhance the used car buying experience, particularly among younger and technology-oriented consumers.

✦ Cars24 – Known for its end-to-end digital transaction platform, Cars24 integrates online listings with offline inspection centers, enabling streamlined buying, selling, and financing processes that appeal to convenience-seeking customers.

✦ Droom – A technology-enabled used car marketplace that incorporates AI-driven valuation tools, transparent vehicle histories, and secure transaction processes to foster trust and transparency in online used car sales.

Ready to Dive Deep? Buy Full Report Today: https://www.persistencemarketresearch.com/checkout/35243

Future Opportunities and Growth Prospects

The India used car market offers strong future opportunities as digital adoption deepens and consumer preferences evolve. Investment in AI-driven valuation, data analytics, and digital engagement platforms will improve transparency and efficiency. Growth in EV infrastructure and hybrid vehicle adoption will broaden the market portfolio. Regulatory support for sustainable mobility will further enhance demand, positioning the sector for continued expansion in the coming decade.

In conclusion, the India used car market is experiencing a transformative phase, combining strong projected growth, innovative technology adoption, and evolving consumer preferences. The sector is set to deliver significant value to buyers, dealers, and technology-driven marketplaces, making it one of the most dynamic segments in the Indian automotive industry.

Persistence Market Research

Persistence Market Research Pvt Ltd

+1 646-878-6329

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.